Renters insurance additional interest lets your landlord know youre covered. Builders Risk will protect a home youre building or remodeling and the tools associated with that project from incidents such as.

Insurance Spotlight Understanding Additional Insured Status Lugenbuhl Wheaton Peck Rankin Hubbard

The first is the named insured meaning the individual or company designated by name in the policy.

. If you dont find the answer youre looking for below our experienced team would be happy to answer any of your questions. They will however be entitled to notice of policy changes and cancellations and will have the same coverage as the. This is done in support of an indemnity obligation within a contract.

Named Insured vs Additional Insured. Therefore underwriters may wish to decline to insure specific Architects Engineers or other professionals as Named Insureds or Additional Named Insureds. A named insured is always covered while an additional insured has certain limitations.

And named insured gives the person you name control over your policy. That is the biggest difference between the concepts of named insured vs additional insured. More specifically for them only incidents that are related to the primary policy holders work and responsibilities are covered.

A named insured is entitled to 100 of the benefits and coverage provided by the policy. This is the benefit of paying for a policy and being a named insured. An additional named insured is an entity that is added to a policy owners policy.

An additional named insured will have the same rights as a Named Insured but typically wont be responsible for the premium. Named Insured The owner of the policy the name found on the declarations page of the policy. Builders Risk underwriters also generally do not intend to cover loss arising from breach of duty negligence or errors and omissions in the course of any professional practice.

An additional insured is someone who is not the owner of the policy but who under certain circumstances may be entitled to some of the benefits and a certain amount of coverage under the. Named Insured Additional Insured and Named Additional Insured are the three most common names the insurance industry gives to people or businesses covered under standard insurance policies. On the contrary Additional insured party enjoys similar benefits while not being subjected to a lot of responsibilities.

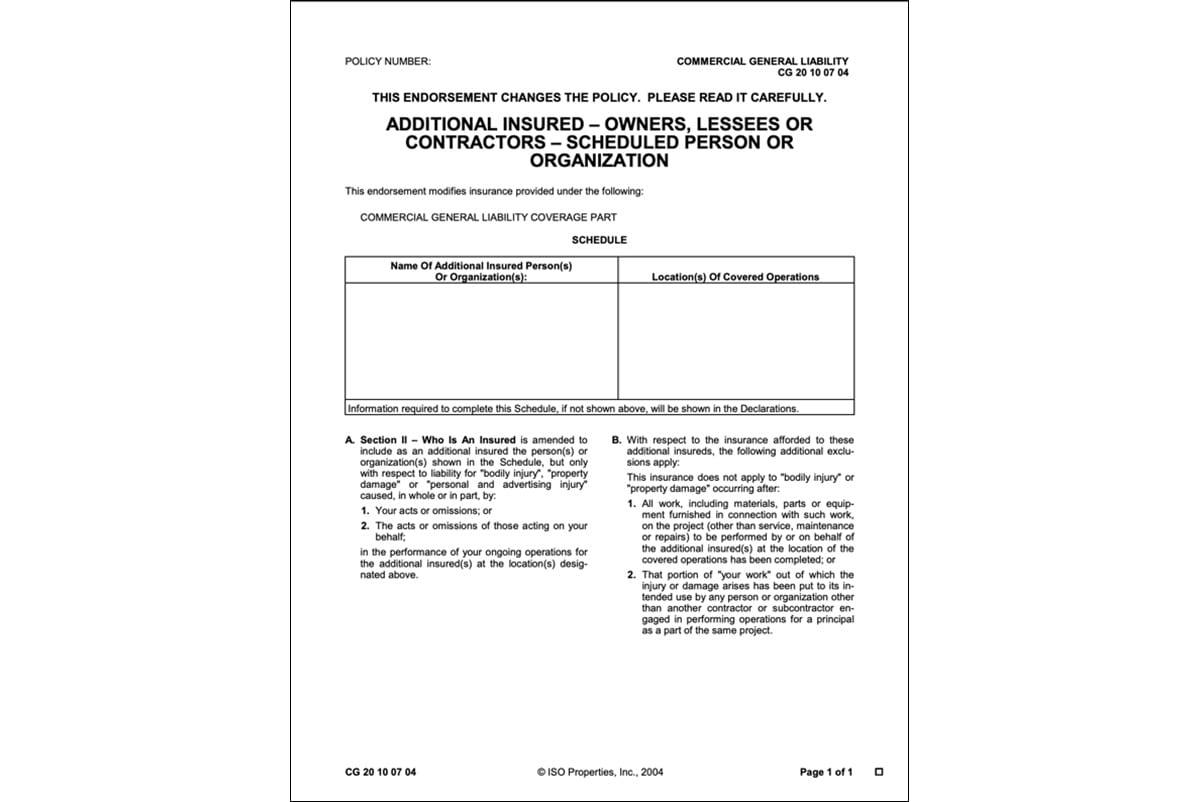

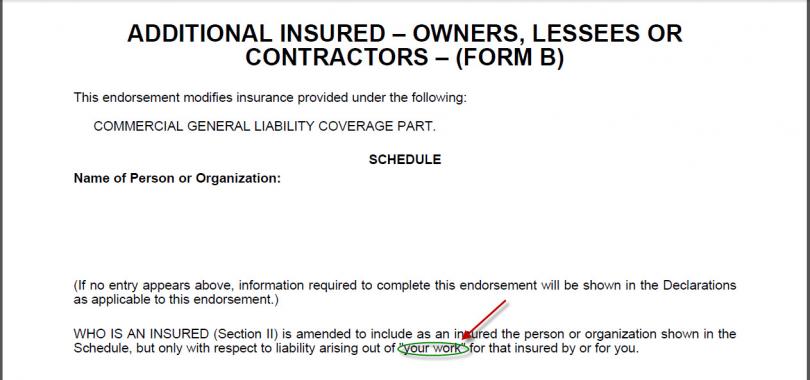

The named insured may be a sole proprietorship partnership corporation or another type of entity. The liability policy refers to the named insured as you or your The named insured is afforded broader protection than other types of insureds. In other words if the additional insured is named in a lawsuit that was directly caused by the named insured the additional insured will be covered by the policy.

Additional Named Insured. The difference is that additional insureds receive only liability protection whereas loss payees receive only property damage coverage. However the policy will cover the additional insured only for damages that have been incurred for operations that were performed on behalf of the named insured.

Your policy will be designed specifically to fit your construction project and the risks it faces. If that seems tricky you can. However in a situation of crisis where the property might have incurred a loss both the insureds are under the coverage and the amount of.

By being named an additional insured the landlord is protected from these types of lawsuits. Conversely an additional insured can only claim something that is involved directly with the named insured. For example an Additional Named Insured can.

Additional Named Insured. The Named insured party has more responsibilities because of the needs of the policy. However the rights afforded to Additional Named Insureds come with risks.

So if a loss occurs. However coverage for the additional insured stops there. The party that has full rights of the policy.

While the project owner general contractor and subcontractors are usually named as insureds on builders. The list above includes just a few examples of the policys coverage. You name your roommate as named insured.

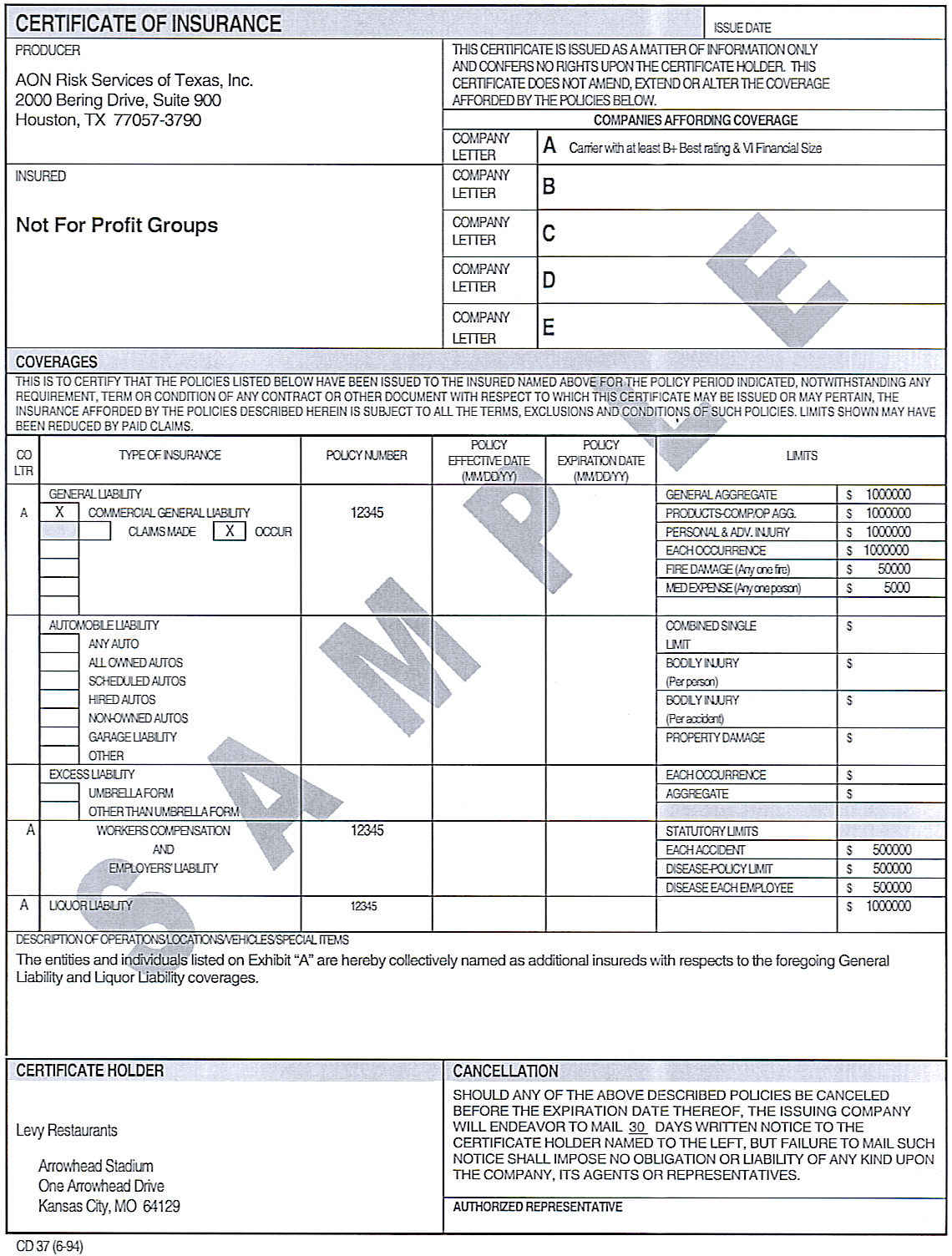

You are the Named Insured and the GC Vendor etc would be an Additional Insured AI on the policy. For example a commercial property owner decides to sell their building but the buyer cannot. First a named insured is the actual owner of the insurance policy.

Therefore an Additional Named Insured has full access to the coverage provided by the policy with very few if any restrictions. To the extent of the wording on the AI endorsement the AI has rights to the policy protections and can file a claim directly with the insurance company without first. These coverages should generally be reserved for the project owner.

Many builders risk policies insure against loss of revenue andor soft costs that result from a project delay due to insured physical damage to the project. When it comes to securing additional insurance coverage under another partys insurance policy interested parties should proceed with care including insisting on a receiving a copy of the underlying insurance policy having that insurance policy reviewed by a professional eg an insurance broker a risk manager andor an attorney and. Additional Named Insureds are considered to be owners of the policy.

There arent huge practical differences between a named insured and an additional named insured. This entitles the additional named insured many benefits and coverages the policy provideswhereas an additional insured is typically a 3rd party added to the Named Insureds policy. Additional Named Insured A person or organization which is also an owner of the policy.

The additional insured will be provided indemnification by the named insured which is why the additional insured has been named in the policy. An Additional Named Insured will have the same rights as a Named Insured with the full policy coverage and will most often be an affiliate partner or co-owner of the primary insured with the same risks and. Claims When it comes time to report a claim the named insured can report any claim that they think may be covered under their insurance policy.

The coverage afforded to an additional insured is limited to liability caused by the named insured. An additional named insured is a person or business that is named somewhere else in the policy. This name appears on the declarations page of the policy and also has full rights of the policy just as the.

Both additional insureds and loss payees are entitled to receive insurance benefits along with the named insured. Adding your landlord general contractor property owner or even your roommate as a named insured isnt a good idea.

The Difference Between Named Insured Additional Insured And Named Additional Insured

Protecting Your Firm As An Additional Insured Virginia Independent Insurance Agent

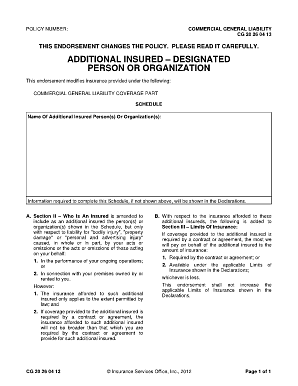

Additional Insured Endorsements Execins Com

Differences Between Named Insured And Additional Insured Part 1

The Basics Of Additional Insured Endorsements

The Basics Of Additional Insured Endorsements

Additional Insured Endorsements In Construction

Questions And Answers On Additional Insured Issues Part 2 Expert Commentary Irmi Com

What S The Difference Between A Loss Payee An Additional Insured

Named Insured Additional Named Insured And Additional Insured What Does This All Mean

Additional Insured A Look At Iso Cg2010 Blades Risk

Builders Risk Naming Of Insureds Reloaded Expert Commentary Irmi Com

Understanding Your Rights As An Additional Insured Florida Construction Legal Updates

What Is An Additional Insured Endorsement Cost Coverage 2022

Certificate Holders Additional Insureds What S The Difference

Differences Between Named Insured And Additional Insured Part 2